Feeling Green

By Trackunit

Features Business IntelligenceA study by Trackunit casts light on evolving attitudes toward sustainability in construction.

Construction has often been depicted as caring little for wider societal or environmental concerns. But if our Sustainability Report for 2024 is anything to go by, that’s no longer accurate and the industry is gearing up to accelerate the battle on emissions.

Survey response

In all, almost 13,000 industry participants took part in this survey and while not all of those managed to plough their way through the 50-plus questions, the fact that many either did or at least answered more than half is indicative of just how important sustainability now is to the industry.

At 73 percent, European respondents dominated the roster as expected with nearly three-quarters, but there was sufficient significant input from North America, Asia, Oceania and Africa to give the findings real global teeth. Collectively, it makes for as complete a platform for research, analysis and insight as can be expected. Contractors, dealers and equipment rental companies were also well represented while those managing public sector construction projects weighed in with approximately four percent of the total.

Top-line results

Forty-nine percent of the survey respondents marked sustainability as “important” or “very important” to their business. That significantly outstrips the 33 percent who fell on the “not important” side of the equation and represents a strong consolidation of the industry’s position despite the severe macro crosswinds impacting business over the last two to three years.

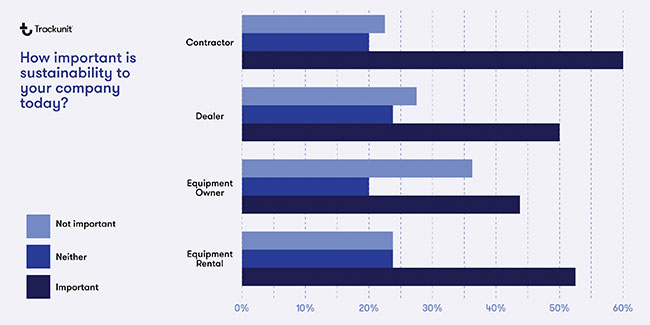

Fifty-nine percent of both the contractor and equipment rental segments of construction posted that sustainability is “important” or “very important.” Dealers and equipment owners respectively scored 51 and 43 percent. Tellingly, the business-as-usual faction was squeezed to the margins with contractors, dealers and equipment rentals registering just 14, 17 and 17 percent respectively as considering sustainability as “not important at all.”

Of the 726 respondents from construction businesses with operating income in excess of $73.5 million per year, 440 ticked sustainability as “important” or “very important” to their business, about 60 percent of the total. That percentage gradually dwindles as cost concerns most likely impact businesses further down the pyramid to the point where companies earning less than $1 million per year mark it at a still respectable 38 percent “important” or “very important.”

There’s a startling 11-percentage-point difference between North American construction companies and their European counterparts with a respective 36 and 25 percent scoring sustainability as “very important.” That differential narrows to nine when those marking it as “important” are included for respective totals of 55 and 46 percent. It reflects a perhaps unexpected but very welcome urgency in North American attitudes to meeting the UN’s 2030 targets on emissions.

It’s evident that the industry is feeling a significant pull from clients on the sustainability agenda with contractors topping out at 59 percent regarding the degree customers see it as “important” or “very important.” Less than one-quarter of contractors considered sustainability to be “not important” or “not important at all” to clients.

The big picture

The global growth in electrical vehicles was projected to reach $561.3 billion U.S. in 2023 and near double to $906.7 billion U.S. by 2028 with 17.07 million vehicles on the road by 2028, according to [research firm] Statista. There are also powerful governmental drives already in place that are changing the landscape, like California’s greenwashing regulations that came into effect on Jan. 1. That has been underpinned by a societal wave that broadly favors action, despite the inevitable costs involved, that mitigates the worst effects of climate change.

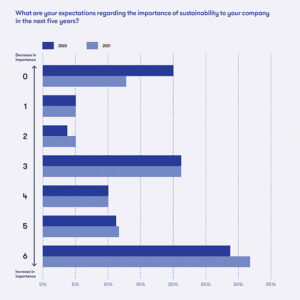

That same sentiment is clearly something construction is tapping into if our survey is anything to go by. When we went to the industry, 49 percent said sustainability would be a key concern for them over the next five years, with 28 percent stating it to be “very important.” To put that in context, only 20 percent said it was “not important at all.”

While that represents a decrease from the same survey in 2021 when 33 percent considered it to be “very important,” the impacts of the COVID crisis, the war in Ukraine and a cost of living crisis that swept through the globe for much of 2022 and 2023 have un- doubtedly weighed heavily on sentiment.

But it has not gone unnoticed that there has been a mood swing in North America

In the last 12 to 24 months. Virginia-headquartered engineering and construction company Bechtel has, for example, firmly established the circular principle at the heart of its sustainability strategy and plans to cut its emissions by 25 percent in the next two years, with hard-and-fast KPIs in place.

Setting a benchmark

While those targets may seem crazy, what Bechtel is doing alongside similar-thinking construction companies is setting a benchmark for the industry to follow. And that standard appears to be infectious, all-consuming and potentially pivotal in accelerating a battle against emissions that, if delivered, could see swathes of the sector fall into line with the UN’s 2030 targets with time to spare.

That culture already exists in much of Europe, led in particular by the Nordic economies. With local government legislation providing the “stick” and the industry’s self-imposed desire to be better acting as the “carrot,” the catalyzing effects of that sentiment are already apparent.

We’ve seen that in the types of machinery being purchased, the transmission of ownership and responsibility to individual machine operators and the long- term battle against downtime that has coalesced into a powerful and magnetic industry-wide movement. With construction estimated to be responsible for about 37 percent of all global emissions, according to a UN report in 2021, a parallel transformation in the industry would be, to put it mildly, timely.

There seems little doubt that key stakeholders are at the very least trying to lead such a revolution. And when dominoes fall, they can fall quickly especially when all the building blocks are in place. It looks like they could be.

Trackunit is a global supplier of telematics and emiisions-tracking technology.

Print this page

Leave a Reply